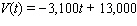

Straight-line depreciation is an accounting method used to help spread the cost of new equipment over a number of years. It takes into account both the cost when new and the salvage value, which is the value of the equipment at the time it gets replaced. The function  where V is value and t is time in years, can be used to find the value of a large copy machine during the first 4 years of use. What is the value of the copier after 1 years and 3 months?

where V is value and t is time in years, can be used to find the value of a large copy machine during the first 4 years of use. What is the value of the copier after 1 years and 3 months?

Definitions:

Sacrificed Action

An act of giving up something valued for the sake of something else regarded as more important or worthy.

Clean Environment

An environment free from pollutants and toxins, often associated with sustainable practices and policies.

Pollution

The release of harmful substances into the natural environment, causing detrimental effects on air, water, soil quality, and overall ecosystem health.

Costs of Production

Costs of production refer to the total expenses incurred in manufacturing a product or offering a service, including raw materials, labor, and overhead costs.

Q20: Use Property 1 for Radicals to write

Q40: Solve the following system by the addition

Q49: Find an equation that has the given

Q80: Solve the following equation. Be sure to

Q81: Let <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Let and

Q91: Solve the equation. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Solve the

Q111: Solve the equation. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Solve the

Q118: Multiply. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Multiply. " class="answers-bank-image

Q136: Find the product. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Find the

Q143: Solve the equation. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Solve the