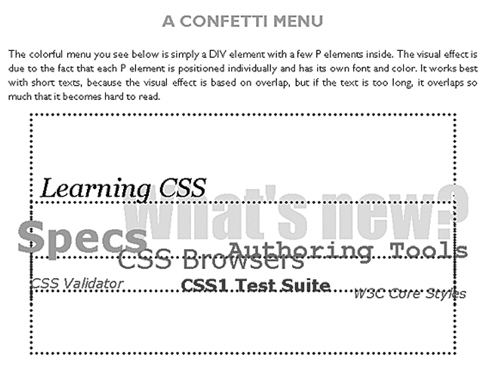

Figure K-7 The figure above shows an effective example of a layer-based menu from one of the online W3C tutorials.

Figure K-7 The figure above shows an effective example of a layer-based menu from one of the online W3C tutorials.

Definitions:

Marginal Tax Rate

The rate at which the next dollar of taxable income would be taxed, reflecting the progressive nature of tax systems.

Average Tax Rate

The ratio of the total amount of taxes paid to the total taxable income, representing the average portion of income that is paid as tax.

Progressive Tax

Progressive tax is a taxation system where the tax rate increases as the taxable amount or income increases, placing a higher burden on those with higher incomes.

Average Tax Rate

The ratio of the total amount of taxes paid to the total tax base (taxable income or spending), essentially reflecting the percentage of income that is paid in taxes.

Q12: You can affect the way an element

Q14: The _ filter effect makes a specified

Q28: Describe at least three broad categories of

Q49: An expandable outline is also called a(n)

Q50: Each object has a default name and

Q51: HTML was originally designed for identifying the

Q78: Explain what a proprietary DHTML feature is

Q81: You can use the _ property to

Q93: Take care not to avoid a common

Q107: Scripts cannot permit users to move items