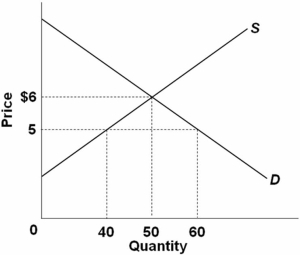

Refer to the graph above.If the price of the product decreases from $6 to $5 because of a decrease in demand (not shown) ,total revenue would:

Refer to the graph above.If the price of the product decreases from $6 to $5 because of a decrease in demand (not shown) ,total revenue would:

Definitions:

Collection Of Cash

The process by which businesses gather or accumulate monetary payments received from customers.

Committed Operating Loan

A loan agreement where the lender agrees to provide a fixed amount of operating capital to a borrower for a specified term.

Non-Committed

Non-Committed in finance refers to facilities or funding that is not contractually guaranteed and can be withdrawn under certain conditions.

Banker's Acceptance

A short-term debt instrument issued by a company that is guaranteed by a commercial bank, commonly used in international trade.

Q29: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4893/.jpg" alt=" The above diagram

Q35: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4893/.jpg" alt=" Refer to the

Q38: Which market model has the least number

Q52: In a market economy,the money incomes of

Q58: It has been proposed that a government

Q71: Which question is an illustration of a

Q71: When total product is increasing at a

Q78: The supply of antiques is highly inelastic

Q117: Economic resources in the capitalist system are

Q132: If the price elasticity of demand for