Required:

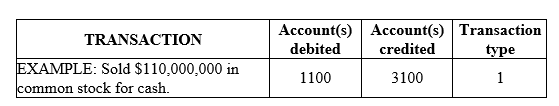

Using the chart of accounts provided, indicate by account number the account or accounts that would be debited and credited in the following transactions. Also enter the number 1, 2, or 3 to indicate the type of transaction as: (1) an external transaction, (2) an internal transaction recorded as an adjusting journal entry, or (3) a closing entry. The company uses a perpetual inventory system. All prepayments are initially recorded in permanent accounts

-Closed the income summary account, assuming there was a net income for the period.

Definitions:

After-Tax Cost

The actual cost of an investment or loan after considering the effects of taxes on its profitability or expense.

Salvage Value

The estimated resale value of an asset at the end of its useful life.

Legal Owner

The person or entity that has legal title or ownership of property or assets.

Tax Benefits

Financial advantages that result from specific tax law provisions, often designed to encourage certain business investments or activities.

Q1: Which of the following is not a

Q6: Rivers given a designation under the Wild

Q8: Which of the following is not a

Q11: Materiality can be affected by the dollar

Q27: Which of the following is NOT an

Q28: Compute net income for the first year

Q130: Identify or define the following terms: periodicity,

Q137: Cash equivalents would include:<br>A) Highly liquid investments

Q139: Distributions to owners<br>A)Net assets.<br>B)Transfers of resources in

Q175: Managers may engage in classification shifting by:<br>A)