Required:

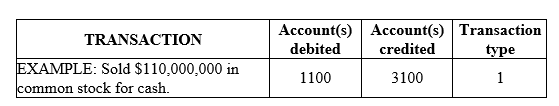

Using the chart of accounts provided, indicate by account number the account or accounts that would be debited and credited in the following transactions. Also enter the number 1, 2, or 3 to indicate the type of transaction as: (1) an external transaction, (2) an internal transaction recorded as an adjusting journal entry, or (3) a closing entry. The company uses a perpetual inventory system. All prepayments are initially recorded in permanent accounts

-Collected a note receivable at maturity, including the interest that had already been accrued.

Definitions:

Mill

A facility for processing raw materials; historically refers to factories for grinding grain into flour.

Emotions

Complex psychological states that involve three distinct components: a subjective experience, a physiological response, and a behavioral or expressive response.

Intentionality

The property of being directed toward some object or situation in the world (a characteristic of mental states such as emotions or beliefs).

Consciousness

Mental awareness (not to be confused with conscience).

Q4: Most real-world income statements are presented using

Q12: The balance in retained earnings at the

Q14: A company may compare the amount of

Q15: Potential sources of contamination of groundwater do

Q18: Inventory

Q21: Which interview question is open-ended?<br>A) Do you

Q43: FASB<br>A)FASB's predecessor.<br>B)Primary national organization of accountants working

Q78: Its receivables turnover ratio for 2018. Round

Q135: AICPA<br>A)FASB's predecessor.<br>B)Primary national organization of accountants working

Q251: Smith & Sons is a CPA firm