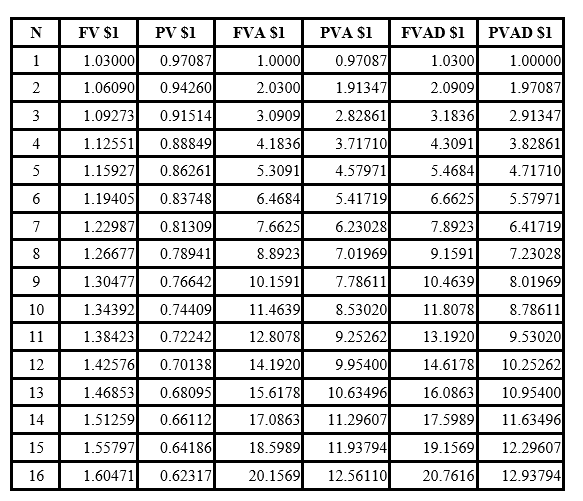

Present and future value tables of $1 at 3% are presented below:

-A firm leases equipment under a long-term lease (analogous to an installment purchase) that calls for 12 semiannual payments of $39,014.40. The first payment is due at the inception of the lease. The annual rate on the lease is 6%. What is the value of the leased asset at inception of the lease?

Definitions:

Initial Investments

The sum of money used to start a business venture, purchase capital assets, or invest in a project.

Income Taxes

Government levies on the earnings of individuals and companies within their territory.

After-Tax Discount Rate

The discount rate used in investment or project valuation that accounts for the effects of taxes on the project's cash flows.

Straight-Line Depreciation

A method of allocating an asset's cost evenly over its useful life.

Q10: Andover Stores uses the average cost retail

Q19: Jimmy has $255,906 accumulated in a 401K

Q24: How much must be invested now at

Q38: If Frasquita accrued interest of $15,000

Q39: Harvey's Wholesale Company sold supplies of

Q145: Which of the following mostly likely would

Q145: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2599/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q165: No allocation of contract price is required

Q275: In 2019, JRE2 would report gross profit

Q311: Assume that Sanjeev estimates variable consideration