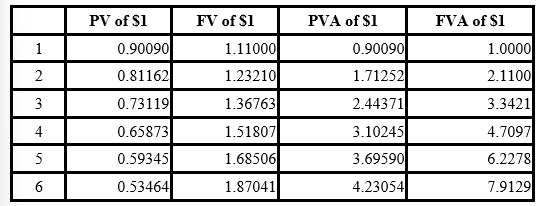

Present and future value tables of $1 at 11% are presented below.

-On October 1, 2018, Justine Company purchased equipment from Napa Inc. in exchange for a noninterest-bearing note payable in five equal annual payments of $500,000, beginning Oct 1, 2019. Similar borrowings have carried an 11% interest rate. The equipment would be recorded at:

Definitions:

Stockouts

Situations where demand cannot be fulfilled because the inventory of a product is exhausted, often resulting in lost sales or customer dissatisfaction.

Inventory Carrying Costs

The total costs associated with holding inventory, including storage, handling, depreciation, and opportunity costs.

Safety Stock

Additional inventory kept on hand to guard against fluctuations in demand or supply, ensuring that sufficient quantities are available to meet customer needs.

Service Level

A measure of performance that shows how effectively a company is delivering services to its customers, often expressed as a percentage.

Q62: A common output method used to measure

Q77: Brockton Carpet Cleaning prepares a bank reconciliation

Q83: Retrospective treatment of prior years' financial statements

Q84: Bunker Auto Supply purchased merchandise on January

Q98: LIFO periodic and LIFO perpetual always produce

Q114: . In its 2018 year-end balance sheet,

Q134: The main difference between perpetual and periodic

Q150: Which of the following is considered a

Q162: Return on shareholders' equity is increased if

Q252: When accounting for revenue over time for