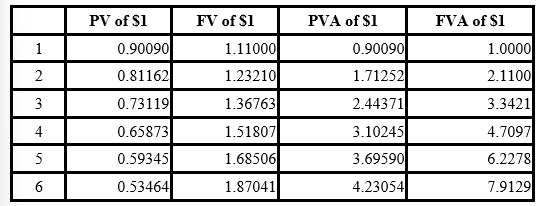

Present and future value tables of $1 at 11% are presented below.

-Polo Publishers purchased a multi-color offset press with terms of $50,000 to be paid at the date of purchase, and a noninterest-bearing note requiring payment of $20,000 at the end of each year for five years. The interest rate implicit in the purchase contract is 11%. Polo would record the asset at:

Definitions:

Allocation Of Risk

Allocation of Risk involves distributing exposure to financial risks among various participants or financial instruments to manage potential losses more effectively.

Ownership And Control

Refers to the legal and operational authority over assets or business, which may not always coincide, especially in corporations with dispersed shareholders.

Commercial Banks

Financial institutions that provide a variety of services, including deposit accounts, loans, and other financial products, to businesses and individuals.

Financial

Relating to money or how money is managed.

Q2: Required: Compute the January 31 ending inventory

Q32: Is there any evidence in Winchester's disclosures

Q57: Baker Inc. acquired equipment from the manufacturer

Q131: In 2019, Indiana incurred additional costs of

Q143: What is Nu's net income if it

Q157: Costs and prices regularly fall every year

Q160: Rahal's final balance in its allowance

Q170: Operating cash flows would not include:<br>A) Interest

Q187: Chen Inc. accepted a two-year noninterest-bearing

Q304: Assume that Steffi paid the $50,000