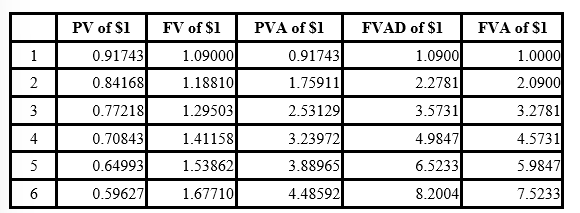

Present and future value tables of $1 at 9% are presented below.

-An investment product promises to pay $42,000 at the end of 10 years. If an investor feels this investment should produce a rate of return of 12%, compounded annually, what's the most the investor should be willing to pay for the investment?

Definitions:

Low Dividend Policy

A strategy where a company decides to distribute a smaller portion of its earnings in the form of dividends to retain more capital for growth.

Clienteles

Clienteles refers to groups of investors or customers who prefer certain policies or characteristics of a company, such as dividend policies, which cater to their specific needs or investment strategies.

Trading Range

Price range between the highest and lowest prices at which a stock is traded.

Dividend Yield

The ratio of a company's annual dividends to its current share price, represented as a percentage.

Q6: Estimated ending inventory at cost is:<br>A)

Q27: Zulu Corporation hires a new chief executive

Q39: Harvey's Wholesale Company sold supplies of

Q61: Hong Kong Clothiers reported revenue of $5,000,000

Q93: The O'Hara Group is owed $1,000,000 by

Q147: Misty's effective tax rate is 40%. What

Q150: Which of the following is considered a

Q174: The following aging information pertains to

Q174: Assume Emmet estimates variable consideration as

Q229: The cost recovery method of accounting for