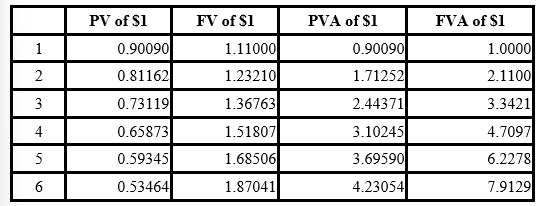

Present and future value tables of $1 at 11% are presented below.

-Spielberg Inc. signed a $200,000 noninterest-bearing note due in five years from a production company eager to do business. Comparable borrowings have carried an 11% interest rate. What is the value of this debt at its inception?

Definitions:

Q4: Bettencourt Clothing Corporation uses a periodic inventory

Q10: Operating cash outflows would include:<br>A) Purchase of

Q35: When you use an aging schedule approach

Q38: Ending inventory assuming LIFO in a

Q61: Hazelton Manufacturing prepares a bank reconciliation at

Q99: <br>Suppose that the Footwear Division's assets had

Q137: In deciding whether financing with receivables is

Q151: Rahal's accounts receivable at December 31,

Q227: If a license gives a customer access

Q286: Which of the following is not true?<br>A)