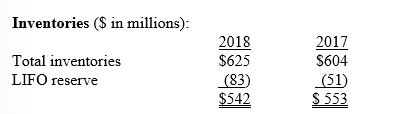

Spando Apparel uses the LIFO inventory method for external reporting and for income tax purposes but maintains its internal records using FIFO. The following disclosure note was included in a recent annual report:

The company's income statement reported cost of goods sold of $3,120 million for the fiscal year ended December 31, 2018.

Required:

1. Spando adjusts the LIFO reserve at the end of its fiscal year. Prepare the December 31, 2018, adjusting entry to record the cost of goods sold adjustment.

2. If Spando had used FIFO to value its inventories, what would cost of goods sold have been for the 2018 fiscal year?

Definitions:

Least Elastic Supply

A situation in the market where the supply of a product or service is least responsive to changes in price.

Midpoint Method

A technique used in economics to calculate the elasticity of demand or supply by averaging the start and end points of a range.

Drug Interdiction

The policy or practice of preventing the importation, trafficking, and use of illegal drugs by enforcement or military means.

Supply Curve

A visual chart illustrating the connection between a product's price and the amount of the product that sellers are ready to manufacture and offer for sale.

Q46: On July 1, 2018, Jekel &

Q47: Dreamworld's average accumulated expenditures for 2018

Q48: Under the LIFO retail method, the denominator

Q50: The table below contains selected financial information

Q90: A contract between a seller and a

Q133: Required: Determine the reported inventory value assuming

Q154: Selected financial statement data from Western Colorado

Q170: Rusty's 2018 income statement would report net

Q181: Cost of goods on consignment is included

Q244: The adjusted market assessment approach can be