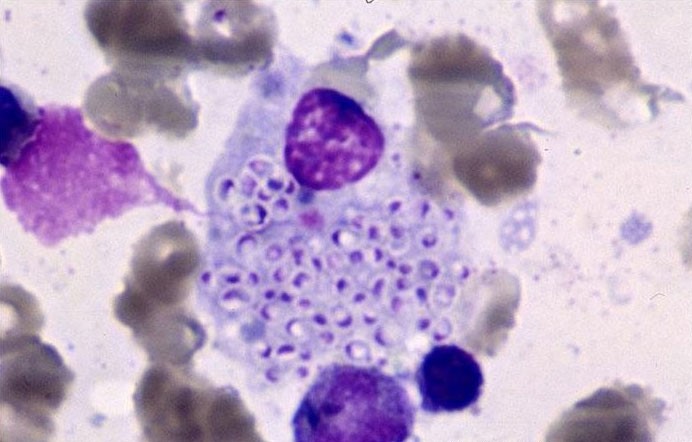

A 54-year-old man with HIV comes to the emergency department due to nonproductive cough, low-grade fevers, and worsening fatigue for the past month. He has also lost 3.6 kg (8 lb) over the same period. The patient does not take antiretroviral therapy consistently and has not followed up with his primary care physician for the past several months. Physical examination reveals hepatosplenomegaly. Laboratory testing shows pancytopenia and elevated liver aminotransferases. Bone marrow aspiration is performed, and light microscopy of the specimen is shown below.  Which of the following is the most likely cause of this patient's current condition?

Which of the following is the most likely cause of this patient's current condition?

Definitions:

Straight-Line Basis

A method of calculating depreciation or amortization by evenly spreading the cost over the useful life of the asset.

Marginal Tax Rate

The rate of tax applied to your next dollar of income, indicating the percentage of tax applied to your income for each tax bracket in which you qualify.

Salvage Value

The forecasted sale price for an asset at the termination of its usability period.

MACRS Depreciation

Modified Accelerated Cost Recovery System; a method of depreciation used for tax purposes in the United States that allows for faster expense deductions.

Q45: A 10-year-old boy is brought to the

Q65: A 38-year-old woman comes to the office

Q72: A 24-year-old man develops mild, nonexudative pharyngitis

Q116: A 2-week-old infant is brought to the

Q253: A 31-year-old man is brought to the

Q271: A 21-year-old man comes to the urgent

Q399: A 37-year-old man comes to the emergency

Q414: A 65-year-old man is referred to a

Q495: A 65-year-old man dies while hospitalized for

Q518: A 53-year-old female treated with high-dose folic