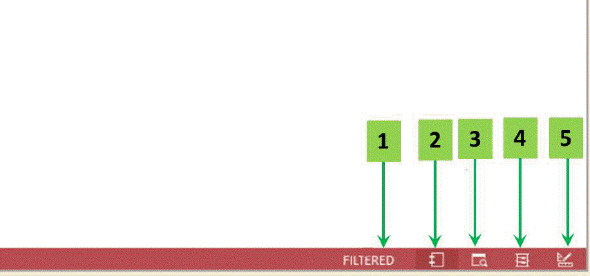

In the accompanying figure, which numbered arrow indicates the Report view button.

Definitions:

Depreciation Deduction

A tax deduction reflecting the decrease in value of an asset over time, applicable to property used for business or investment.

Depreciation Tables

Charts provided by the IRS to determine the amount of depreciation expense that can be deducted for different types of property over their useful lives.

Land Value

Represents the worth of a piece of land, determined by its location, size, and potential for development or agricultural use.

Depreciation Deduction

A tax deduction that allows the cost of an asset to be spread over its useful life.

Q1: A report created using the Report Wizard

Q2: When two files are linked together, the

Q4: What is the function of air intake

Q9: A diesel engine produces pronounced combustion knock

Q10: Case Based Critical Thinking Questions Case 7-

Q14: The format field command freezes a field

Q30: Layout view must be used to select

Q52: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9151/.jpg" alt=" In the accompanying

Q85: In Excel, a collection of similar data

Q89: Yes/No field values are stored in an