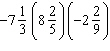

How many terms are in the expression?

Definitions:

Implicit Marginal Tax Rate

The effective rate at which an additional dollar of income is taxed, taking into account both explicit taxes and the phase-out of benefits or allowances.

Government Transfers

Payments by the government to individuals or entities without the expectation of direct repayment or work in return, often taking the form of welfare, subsidies, or grants.

Tax Rate

The percentage at which an individual or corporation is taxed by the government.

Economic Analysis

A systematic approach to examining the allocation of resources, focusing on the production, distribution, and consumption of goods and services.

Q25: Add the fractions. Reduce to simplest form.

Q72: A 67-year-old man comes to the office

Q112: The table below describes the average temperatures

Q125: If the net change of a function

Q195: Use the table to make a bar

Q326: A 32-year-old man comes to the physician

Q441: A 52-year-old African American man comes to

Q603: A 54-year-old woman comes to the emergency

Q828: A 60-year-old man with long-standing type 2

Q847: A 52-year-old man comes to the office