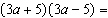

Find the product and simplify.

Definitions:

Rules Of Exponents

Mathematical rules that govern the operations on numbers with exponents, such as multiplication and division of powers.

Expression

A mathematical phrase that can contain numbers, variables, and operation symbols but not an equality sign.

X

In mathematics, "X" is commonly used to represent an unknown quantity or variable in equations and expressions.

Y

Often represents the vertical coordinate or dependent variable in a Cartesian coordinate system.

Q8: Find the solution to the given matrix

Q19: The mass of Earth is about <img

Q44: The mouse population in a small desert

Q102: Simplify the rational expression. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8673/.jpg" alt="Simplify

Q106: The expression <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8673/.jpg" alt="The expression

Q117: Use the graph to estimate the vertex

Q139: Perform the operation and write the answer

Q175: As a first step in solving the

Q233: A point in the solution set must

Q274: Your business making doodads has the following