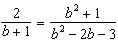

Solve the equation.

Definitions:

Double Declining-balance

A method of accelerated depreciation that doubles the straight-line depreciation rate.

Depreciation Expense

This refers to the allocation of the cost of a tangible asset over its useful life, representing how much of the asset's value has been used up during a fiscal period.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded against an asset since it was put into service.

Straight-line Method

An accounting method for calculating depreciation by evenly distributing the cost of an asset over its useful life.

Q1: If a quadratic model <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8673/.jpg" alt="If

Q2: Given the data set draw a scatterplot.

Q2: For the polynomial expression factor out the

Q67: Differential revenue is the amount of income

Q145: Is the given value of the variable

Q171: Use the Pythagorean Theorem to solve for

Q172: Find the vertex of the given equation

Q201: Solve the equation. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8673/.jpg" alt="Solve the

Q222: Find the solution of the system of

Q259: Add or subtract the rational expressions. Reduce