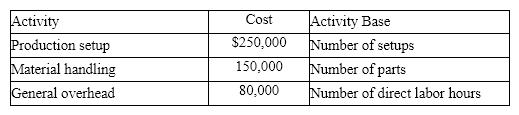

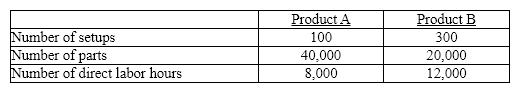

Miramar Industries manufactures two products: A and B. The manufacturing operation involves three overhead activities-production setup, material handling, and general factory activities. Miramar uses activity-based costing to allocate overhead to products. An activity analysis of the overhead revealed the following estimated costs and activity bases for these activities:

What is the activity rate for production setup?

What is the activity rate for production setup?

Definitions:

Net Income

The net income of a company once all costs and taxes are deducted from its total revenue.

Short-Term Stock Investments

Investments in stocks that are intended to be held for a short period, typically less than one year, for earning quick profits.

Cash Dividends

Payments made by a corporation to its shareholder members. It is the share of profits distributed.

Mikel Company Bonds

Debt securities issued by Mikel Company to investors, representing loans made by investors to the company.

Q17: Starling Co. is considering disposing of a

Q31: On the statement of cash flows, the

Q40: Finch, Inc. has bought a new server

Q55: Connally Company's payroll department required that every

Q85: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9037/.jpg" alt=" From the above

Q87: Piper Corp. is operating at 70% of

Q124: If in evaluating a proposal by use

Q164: What cost concept used in applying the

Q225: The quadratic formula states that the solutions

Q238: You are able to rake the yard