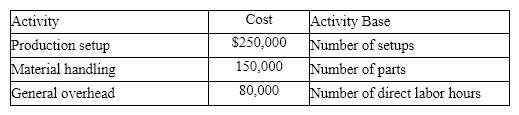

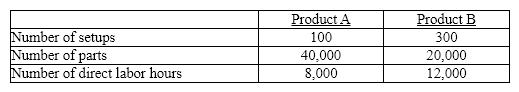

Miramar Industries manufactures two products: A and B. The manufacturing operation involves three overhead activities-production setup, material handling, and general factory activities. Miramar uses activity-based costing to allocate overhead to products. An activity analysis of the overhead revealed the following estimated costs and activity bases for these activities:

What is the activity rate for general overhead?

What is the activity rate for general overhead?

Definitions:

Cost Allocated

The process of distributing indirect costs to different departments, products, or projects within an organization.

Sales Department

The division within a business focused on sales and customer acquisition strategies.

Step-Down Method

An accounting method used to allocate service department costs to producing departments in a sequential manner, based on a hierarchy of services provided.

Support Department

Units within an organization that provide essential services or assistance to the main production or operation departments but do not directly produce revenue.

Q3: When you estimate an output value for

Q10: One inherent risk to using lean philosophy

Q25: Decide which line fits the data best.<br>A)

Q40: A quadratic model for the median home

Q54: Conan Electronics Corporation manufactures and assembles electronic

Q55: Connally Company's payroll department required that every

Q93: Which of the following should be deducted

Q113: If a proposed expenditure of $80,000 for

Q154: Which of the following should be added

Q164: Simplify the radical then approximate it to