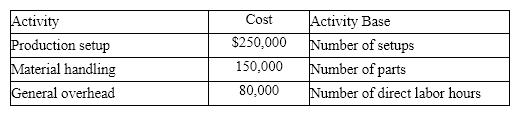

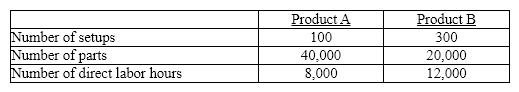

Miramar Industries manufactures two products: A and B. The manufacturing operation involves three overhead activities-production setup, material handling, and general factory activities. Miramar uses activity-based costing to allocate overhead to products. An activity analysis of the overhead revealed the following estimated costs and activity bases for these activities:

What is the total overhead allocated to Product A using activity-based costing?

What is the total overhead allocated to Product A using activity-based costing?

Definitions:

Straight-Line Depreciation

A method of allocating the cost of a tangible asset evenly over its useful life.

Capital Budgeting

The process of evaluating and selecting long-term investments that are in line with the company's strategic objectives, focusing on projects that will generate value over time.

Incremental Sales

The increase in sales revenue attributed to a specific marketing effort or event.

Operating Expenses

Costs incurred in the day-to-day operations of a business, excluding the cost of goods sold, such as rent, salaries, and utilities.

Q6: The profit P in dollars that you

Q11: Given the data set draw a scatterplot.

Q40: Solve the quadratic equation by using the

Q48: All of the following are factors that

Q95: Equipment with an original cost of $75,000

Q102: The Swan Company produces its product at

Q140: Simplify the radical then approximate it to

Q162: Divide and simplify. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8673/.jpg" alt="Divide and

Q164: Simplify the radical then approximate it to

Q209: Your revenue from baking and selling cakes