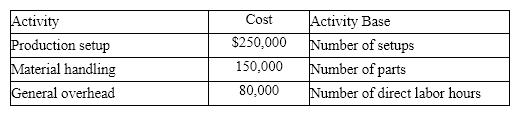

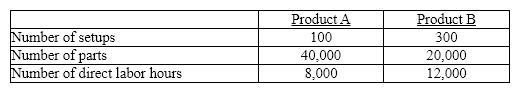

Miramar Industries manufactures two products: A and B. The manufacturing operation involves three overhead activities-production setup, material handling, and general factory activities. Miramar uses activity-based costing to allocate overhead to products. An activity analysis of the overhead revealed the following estimated costs and activity bases for these activities:

What is the activity rate for material handling?

What is the activity rate for material handling?

Definitions:

Gross Profit

The difference between revenue and the cost of goods sold before deducting operating expenses, interest, and taxes.

Operating Expenses

Costs related to the primary activities of a business, excluding costs of goods sold.

Cost of Goods Sold

The direct costs attributable to the production of the goods sold in a company, including the cost of materials and labor.

Net Sales

The amount of revenue from sales after deducting returns, allowances for damaged or missing goods, and discounts.

Q17: Below is a table for the present

Q30: Decisions to install new equipment, replace old

Q39: Solve the equation. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8673/.jpg" alt="Solve the

Q74: If the total unit cost of manufacturing

Q75: Solve the quadratic equation. Give both the

Q84: Activity-based costing is determined by charging products

Q135: If a gain of $11,000 is realized

Q141: The box below lists the nutritional information

Q144: You _ <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8673/.jpg" alt="You _

Q196: You are able to stock the shelves