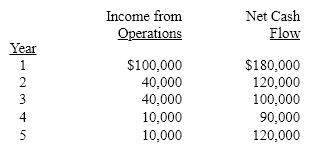

The management of Arkansas Corporation is considering the purchase of a new machine costing $490,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for 1 through 5 years are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability of this investment:  The net present value for this investment is

The net present value for this investment is

Definitions:

Underlying Connective Tissue

The supportive tissue that lies beneath epithelial tissue, providing structural and nutritional support to epithelial cells.

Pseudostratified Columnar

Describes a type of epithelial tissue where cells of different heights appear to be in layers, but all cells are attached to the basement membrane.

Simple Squamous

A type of epithelial cell that is flat and thin, often found lining surfaces involved in passive diffusion, such as the alveoli in the lungs.

Basement Membrane

A thin, dense layer of extracellular matrix that separates epithelial or endothelial cells from the underlying connective tissue.

Q4: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8673/.jpg" alt="If then

Q17: Based on the following data for the

Q30: To determine cash payments for operating expenses

Q54: Given a quadratic model <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8673/.jpg" alt="Given

Q60: If the prediction of the output value

Q93: Determine the average rate of return for

Q156: Cash dividends of $50,000 were declared during

Q158: Magpie Corporation uses the total cost concept

Q161: Under the total cost concept, manufacturing cost

Q161: The last item on the statement of