Norton Company is considering a project that will require an initial investment of $750,000 and will return $200,000 each year for 5- years.

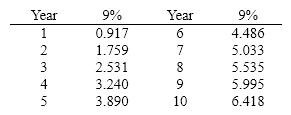

(a) If taxes are ignored and the required rate of return is 9%, what is the project's net present value?

(b) Based on this analysis, should Norton Company proceed with the project?

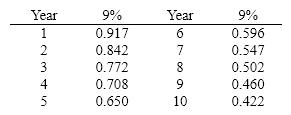

Below is a table for the present value of $1 at compound interest.

Below is a table for the present value of an annuity of $1 at compound interest.

Definitions:

Domestic Producers

Local manufacturers or producers who create goods and services within a country's borders, contributing to the domestic economy.

Foreign Producers

Companies or individuals that produce goods or services in a country other than the one where the goods or services are consumed.

Tariff Revenue

The income generated by the government from taxing imports.

International Trade

The exchange of goods and services across international borders or territories, involving importation and exportation.

Q8: When using the total cost concept of

Q16: On the statement of cash flows prepared

Q16: Mighty Safe Fire Alarm is currently buying

Q18: The denominator of the rate of return

Q26: A quality control activity analysis indicated the

Q84: Activity-based costing is determined by charging products

Q92: Solve the quadratic equation. Give both the

Q93: Hill Co. can further process Product O

Q107: Which of the following is required by

Q118: Cash flow per share is<br>A) required to