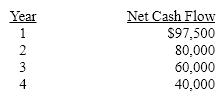

Sunrise Inc. is considering a capital investment proposal that costs $227,500 and has an estimated life of 4 years and no residual value. The estimated net cash flows are as follows:

The minimum desired rate of return for net present value analysis is 10%. The present value of $1 at compound interest rates of 10% for 1, 2, 3, and 4 years is 0.909, 0.826, 0.751, and 0.683, respectively. Determine the net present value. Round interim answers to the nearest dollar.

Definitions:

Disadvantages

The unfavorable or negative aspects of a particular situation or choice.

Joint Venture

A business arrangement in which two or more parties agree to pool their resources for the purpose of accomplishing a specific task or project, often sharing revenues, expenses, and control.

Authority

The power or right to give orders, make decisions, and enforce obedience.

General Partners

General partners are individuals or entities that participate in the management of a partnership and have unlimited personal liability for its debts.

Q1: The amount of the average investment for

Q16: Mighty Safe Fire Alarm is currently buying

Q22: For each of the following, identify whether

Q55: The percentage of eighth grade students P

Q64: Given the data set draw a scatterplot.

Q67: On the statement of cash flows, the

Q92: The lean philosophy views inventory as a

Q109: What is capital investment analysis? Why are capital

Q117: Which of the following is a present

Q143: Moon Company uses the variable cost concept