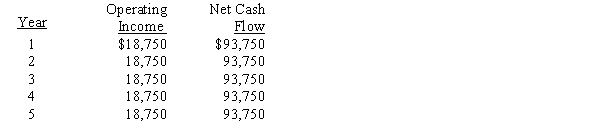

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for 5 years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-The expected average rate of return for a proposed investment of $650,000 in a fixed asset, with a useful life of 4 years, straight-line depreciation, no residual value, and an expected total net income of $240,000 for the 4 years, is

Definitions:

Asymmetric Carbon

A carbon atom bonded to four different groups, creating a chiral center and potentially optical activity in the molecule.

R or S

Descriptors in chemistry that indicate the absolute configuration of chiral centers in molecules, determining their spatial arrangement as right-handed (R) or left-handed (S).

Stereochemistry

The study of the spatial arrangement of atoms within molecules and its influence on the chemical and physical properties of substances.

(S)-3-chloro-3-methylhexane

A chiral compound with a specific three-dimensional arrangement around the chiral center, designated by the (S) configuration.

Q18: The percentage P of 6 to 11

Q27: Which of the following statements best describes

Q42: In a lean environment, operations only respond

Q51: Under a lean environment, employees have the

Q54: Conan Electronics Corporation manufactures and assembles electronic

Q83: A commercial oven with a book value

Q120: A backflush accounting system uses work in

Q138: Solve the radical equation. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8673/.jpg" alt="Solve

Q165: Widgeon Co. manufactures three products: Bales, Tales,

Q182: Multiply the radicals and simplify. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8673/.jpg"