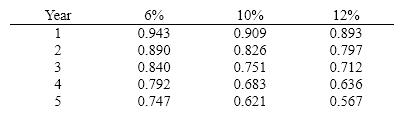

Below is a table for the present value of $1 at compound interest.

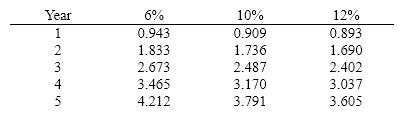

Below is a table for the present value of an annuity of $1 at compound interest.

Using the tables above, what is the present value of $6,000 to be received at the end of each of the next 4 years, assuming an earnings rate of 10%?

Definitions:

Generalized Fisher Effect

A theory stating that the real interest rate is independent of monetary measures, with nominal interest rates adjusting to expected inflation.

Real Interest Rates

The interest rates adjusted for inflation, representing the true cost of borrowing and the real yield to lenders or investors.

Forward Exchange Rate

The rate agreed today for exchange of two currencies at a future date, used in forward contracts.

Interest Rate Differentials

The difference in interest rates between two distinct economic or financial regions, affecting currency values and investment flows.

Q17: Rationalize the denominator and simplify. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8673/.jpg"

Q24: Which of the following is an example

Q38: The graph shows the average monthly high

Q44: When a bottleneck occurs between two products,

Q62: Under the lean production concept, employees are

Q123: Free cash flow is<br>A) all cash in

Q135: The theory of constraints is a manufacturing

Q153: The following information is available from the

Q157: To arrive at cash flows from operations,

Q160: The cost of merchandise sold during the