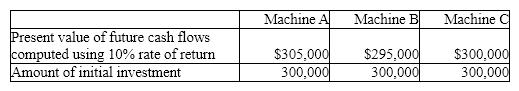

The production department is proposing the purchase of an automatic insertion machine. It has identified 3 machines and have asked the accountant to analyze them to determine which of the proposals (if any) meet or exceed the company's policy of a minimum desired rate of return of 10% using the net present value method. Each of the assets has an estimated useful life of 10 years. The accountant has identified the following data:

Which of the investments are acceptable?

Definitions:

Secondary Reserves

Liquid assets held by financial institutions that are not used for primary obligations but can be quickly converted to cash for emergency needs.

U.S. Government Securities

Financial instruments issued by the United States Department of the Treasury to finance federal government's expenditures.

Vault Cash

Currency and coins held by a bank in its vault and used to satisfy the bank's reserve requirements.

Securities

Financial instruments representing ownership (stocks), a creditor relationship with a government or corporation (bonds), or other rights to ownership or profit.

Q4: Cash flows from operating activities, as part

Q22: Use the Pythagorean Theorem to solve for

Q47: The population of the District of Columbia

Q69: Maximum effectiveness and efficiency are reached when

Q97: The expected average rate of return for

Q98: In computing the rate earned on total

Q121: A business issues 20-year bonds payable in

Q124: Solve the quadratic equation by using the

Q158: A rock is dropped from a building

Q164: If a proposed expenditure of $70,000 for