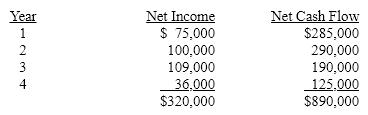

Dickerson Co. is evaluating a project requiring a capital expenditure of $810,000. The project has an estimated life of 4 years and no salvage value. The estimated net income and net cash flow from the project are as follows:

The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is 0.893, 0.797, 0.712, and 0.636, respectively.

Determine the average rate of return on investment, including the effect of depreciation on the investment.

Definitions:

Cognitive Neuroscience

An academic field concerned with the scientific study of biological processes and aspects that underlie cognition, with a focus on the neural connections in the brain.

Expression of Emotions

The process by which individuals communicate their feelings to others through facial expressions, body language, and verbal cues.

Conditions of Worth

Conditions or standards imposed by others that one feels they must meet in order to be valued or accepted.

Transient Ways

Temporary or short-term methods or paths one might take in various contexts.

Q7: Miramar Industries manufactures two products: A and

Q8: The method of analyzing capital investment proposals

Q24: Does the data graphed follow a linear

Q47: Methods that ignore present value in capital

Q59: Free cash flow is flow cash from

Q62: Which of the following types of transactions

Q115: Lead time reduction can be a cost-saving

Q137: The management of Wyoming Corporation is considering

Q163: In a common-sized income statement, 100% is

Q170: A company purchases equipment for $32,000 cash. This