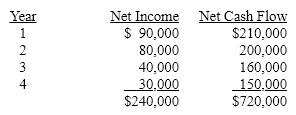

Vanessa Company is evaluating a project requiring a capital expenditure of $480,000. The project has an estimated life of 4 years and no salvage value. The estimated net income and net cash flow from the project are as follows:

The company's minimum desired rate of return for net present value analysis is 15%. The present value of $1 at compound interest of 15% for 1, 2, 3, and 4 years is 0.870, 0.756, 0.658, and 0.572, respectively.

Determine

(a) the average rate of return on investment, using straight-line depreciation, and

(b) the net present value.

Definitions:

Vertical Integration

describes a strategy where a company expands its operations into different stages of production within its industry, often to control the supply chain or reduce dependency on suppliers.

E-Procurement

The electronic procurement process that utilizes online systems and technology to streamline purchasing, reduce costs, and enhance vendor management.

Vendor Selection

The process of evaluating and choosing suppliers based on criteria such as price, quality, reliability, and service.

Final Assembly

The phase in manufacturing where parts or components are assembled to create the finished product.

Q2: The process by which management plans, evaluates,

Q5: Relevant revenues and costs refer to<br>A) activities

Q24: Solve the quadratic equation by using the

Q34: Using the following partial table of present

Q38: The graph shows the average monthly high

Q38: Which of the following is not one

Q40: The management of Charlton Corporation is considering

Q48: All of the following are factors that

Q57: Solve the quadratic equation. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8673/.jpg" alt="Solve

Q146: Jacoby Company received an offer from an