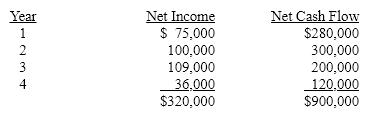

Dickerson Co. is evaluating a project requiring a capital expenditure of $810,000. The project has an estimated life of 4 years and no salvage value. The estimated net income and net cash flow from the project are as follows:

The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is 0.893, 0.797, 0.712, and 0.636, respectively.

Determine the net present value.

Definitions:

Top Management

The highest level of executives responsible for the strategic direction and decision-making in an organization.

Trust the Process

A phrase encouraging belief in and adherence to a specific plan or system, despite potential uncertainty or slow progress.

Electronic Data Interchange (EDI)

The electronic transfer of business information using a standardized format, allowing different systems to communicate directly with each other.

Process Cycle Time

measures the total time taken to complete a business process from start to finish, indicating process efficiency.

Q14: Which method of evaluating capital investment proposals

Q39: During the years 1994 to 2007 seat

Q42: In a lean environment, operations only respond

Q72: Sales reported on the income statement were

Q92: Mallard Corporation uses the product cost concept

Q152: Solve the quadratic equation. Give both the

Q157: In the vertical analysis of an income

Q165: In the vertical analysis of a balance

Q173: The production department is proposing the purchase

Q177: Solve the quadratic equation by using the