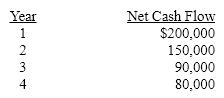

A $400,000 capital investment proposal has an estimated life of 4 years and no residual value. The estimated net cash flows are as follows:

The minimum desired rate of return for net present value analysis is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is 0.893, 0.797, 0.712, and 0.636, respectively.

Determine the net present value.

Definitions:

Direct Write-Off Method

A method of accounting for bad debts that involves charging unpaid accounts directly to the expense account when they are determined to be uncollectible.

Bad Debt Expense

The operating expense incurred because of the failure to collect receivables.

Account Receivable

Account Receivable represents funds owed to a company by clients or customers who have purchased goods or services on credit.

Account Receivable

Funds that customers owe a company for products or services received but not yet compensated for.

Q23: Which of the following is a value-added

Q27: Since the costs of producing an intermediate

Q56: In horizontal analysis, the current year is

Q60: A rock is dropped from a building

Q67: Differential revenue is the amount of income

Q74: The graph shows the average monthly high

Q82: Financial accounting information is used more often

Q98: In computing the rate earned on total

Q121: Which of the following is a method

Q135: If a gain of $11,000 is realized