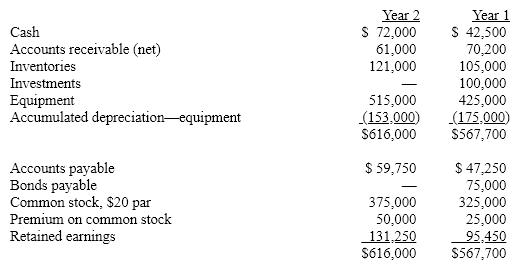

The comparative balance sheet of Barry Company for Years 1 and 2 ended December 31 appears below in condensed form:

Additional data for the current year are as follows:

(a) Net income, $75,800.

(b) Depreciation reported on income statement, $38,000.

(c) Fully depreciated equipment costing $60,000 was scrapped, no salvage, and equipment was purchased for $150,000.

(d) Bonds payable for $75,000 were retired by payment at their face amount.

(e) 2,500 shares of common stock were issued at $30 for cash.

(f) Cash dividends declared and paid, $40,000.

(g) Investments of $100,000 were sold for $125,000.

Prepare a statement of cash flows using the indirect method.

Definitions:

Accounts Payable Period

The average duration it takes for a company to pay off its suppliers after receiving goods or services.

Accounts Receivable Period

The mean duration that a company requires to receive payments from credit sales, reflecting the effectiveness of its policies on credit and collections.

Operating Cycle

The period of time between the acquisition of inventory by a company and the receipt of cash from accounts receivable from the sale of that inventory.

Inventory Period

The time it takes for a company to turn its inventory into sales.

Q8: The method of analyzing capital investment proposals

Q11: A make-to-order company matches its production schedules

Q14: Given the following data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9037/.jpg" alt="Given

Q16: On the statement of cash flows prepared

Q54: Eco-efficiency measures are a form of managerial

Q60: The percentage analysis of increases and decreases

Q61: An 8-year project is estimated to cost

Q132: If the underapplied factory overhead amount is

Q140: Which of the following statements is false?<br>A)

Q166: Costs other than direct materials cost and