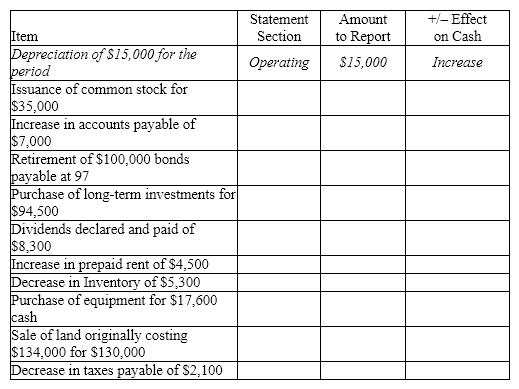

Complete each of the columns on the table below, indicating in which section each item would be reported on the statement of cash flows (operating, investing, or financing), the amount that would be reported, and whether the item would create an increase or decrease in cash. For item that affect more than one section of the statement, indicate all affected. Assume the indirect method of reporting cash flows from operating activities.

The first item has been completed as an example.

Definitions:

Flexible Budget

A budget that adjusts or flexes with changes in volume or activity levels, providing a more useful tool for performance evaluation.

Variable Costs

Costs that vary directly with the level of production or business activity. Examples include raw materials, packaging, and direct labor.

Fixed Costs

Fixed Costs are business expenses that remain constant regardless of the volume of goods or services produced, such as rent, salaries, and loan payments.

Favorable Volume Variance

A metric that indicates a company has produced or sold more than initially anticipated, leading to increased profitability.

Q4: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9037/.jpg" alt=" From the above

Q6: Cost accounting systems measure, record, and report

Q13: The computations involved in the net present

Q18: There is no difference in the investing

Q64: A company can use comparisons of its

Q109: In a pull manufacturing system, raw materials

Q116: By converting dollars to be received in

Q122: Cash, as the term is used for

Q136: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9037/.jpg" alt=" Based on the

Q142: Richards Corporation had net income of $250,000