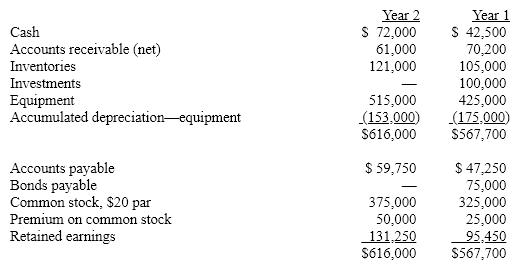

The comparative balance sheet of Barry Company for Years 1 and 2 ended December 31 appears below in condensed form:

Additional data for the current year are as follows:

(a) Net income, $75,800.

(b) Depreciation reported on income statement, $38,000.

(c) Fully depreciated equipment costing $60,000 was scrapped, no salvage, and equipment was purchased for $150,000.

(d) Bonds payable for $75,000 were retired by payment at their face amount.

(e) 2,500 shares of common stock were issued at $30 for cash.

(f) Cash dividends declared and paid, $40,000.

(g) Investments of $100,000 were sold for $125,000.

Prepare a statement of cash flows using the indirect method.

Definitions:

Voting Shares

Shares that give the shareholder the right to vote on company matters, such as electing directors or approving acquisitions, indicating a degree of control in the company.

Retained Earnings

The portion of net income left over for the business after it has paid out dividends to its shareholders.

Carrying Amount

The book value of assets and liabilities as reported in the financial statements, factoring in depreciation, amortization, and impairment.

Voting Shares

Shares that give the shareholder the right to vote on matters of corporate policy and the selection of board members.

Q5: Income statement information for Sadie Company is

Q24: Activity-based costing is a method of accumulating

Q29: What is the present value of $8,000

Q39: Set up time is disregarded as an

Q93: When the goods are sold, their costs

Q93: Which of the following should be deducted

Q101: Since there are few rules to restrict

Q120: Goods that are partway through the manufacturing

Q130: The board of directors declared cash dividends

Q147: In a vertical analysis, the base for