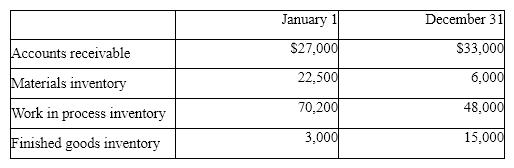

Davis Manufacturing Company had the following data:

Collections on account were $625,000.

Cost of goods sold was 68% of sales.

Direct materials purchased amounted to $90,000.

Factory overhead was 300% of the cost of direct labor.

Compute:

(a) Sales revenue (all sales were on account)

(b) Cost of goods sold

(c) Cost of goods manufactured

(d) Direct labor used

(e) Direct materials incurred

(f) Factory overhead incurred

Definitions:

Partnership Agreement

A legal document that specifies the rights, responsibilities, and distribution of profits and losses among partners in a business partnership.

Salary Allowances

Salary allowances refer to the specific amounts granted to employees over their basic salary for various purposes, such as housing, transportation, or medical expenses.

Income Statements

A financial statement that shows a company's revenues and expenses over a specific period, leading to net profit or loss.

Drawing Accounts

Accounts used to track withdrawals made by the owners of a business for personal use, reducing the owner's equity in the company.

Q7: Depreciation on factory plant and equipment is

Q71: A company with $70,000 in current assets

Q76: Selected data for the current year ended

Q88: A cost object indicates how costs are

Q112: Planning is the process of developing the

Q113: Direct labor cost is an example of

Q121: A business issues 20-year bonds payable in

Q122: Which of the following ratios provides a

Q169: When using the spreadsheet (work sheet) for

Q182: Cash and accounts receivable for Adams Company