The following is a list of costs incurred by several business organizations:

(a) Telephone cable for a telephone company

(b) Membership fees for a health club for executives

(c) Salary of the director of internal auditing

(d) Long-distance telephone bill for calls made by salespersons

(e) Carrying cases for a manufacturer of video camcorders

(f) Cotton for a textile manufacturer of blue jeans

(g) Bandages for the emergency room of a hospital

(h) Cost of company holiday party

(i) Electricity used to operate factory machinery

(j) State unemployment compensation taxes for factory workers

(k) Gloves for factory machine operators

(l) Fees paid for lawn service for office grounds

(m) Salary of secretary to vice-president of finance

(n) Salary of secretary to vice-president of marketing

(o) Production supervisor's salary

(p) Engine oil for manufacturer and distributor of motorcycles

(q) Oil lubricants for factory plant and equipment

(r) Cost of a radio commercial

(s) Depreciation on factory equipment

(t) Wages of checkout clerk in company-owned retail outlet

(u) Maintenance and repair costs for factory equipment

(v) Depreciation on office equipment

(w) Bonuses paid to salespersons

(x) Insurance on factory building

(y) Training for accounting personnel on use of microcomputer

(z) Steel for a construction contractor

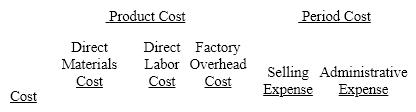

Classify each of the preceding costs as product costs or period costs. For those costs classified as product costs, indicate whether the product cost is a direct materials cost, direct labor cost, or factory overhead cost. For those costs classified as period costs, indicate whether the period cost is a selling expense or an administrative expense. Use the following tabular headings for preparing your answer. Place an X in the appropriate column.

Definitions:

Variable Costs

Costs that change in proportion to the level of output or activity.

Total Costs

The sum of all expenses associated with the production of goods or services, including both fixed and variable costs.

Output

The amount of goods or services produced by a person, machine, factory, or country.

Variable Costs

Costs that change in proportion to the volume of goods or services produced.

Q3: Classify the following costs as either a

Q6: Work in process inventory on December 31

Q24: A production supervisor's salary that does not

Q45: Bar code scanners are now being used

Q76: Period (nonmanufacturing) costs are classified into two

Q81: The Winston Company estimates that the factory

Q90: If sales total $2,000,000, fixed costs total

Q102: Prepare the journal entry for materials and

Q146: A firm operated at 90% of capacity

Q172: All of the following employees hold line