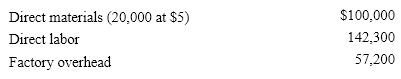

Department J had no work in process at the beginning of the period; 18,000 units were completed during the period; and 2,000 units were 30% completed at the end of the period. The following manufacturing costs were debited to the departmental work in process account during the period (Assume the company uses FIFO and rounds cost per unit to two decimal places) :  Assuming that all direct materials are placed in process at the beginning of production, what is the total cost of the 18,000 units completed during the period?

Assuming that all direct materials are placed in process at the beginning of production, what is the total cost of the 18,000 units completed during the period?

Definitions:

Units Produced

The total number of complete products manufactured during a specific period.

Direct Costs

Expenses that can be directly attributed to the production of specific goods or services, such as raw materials and labor.

Merchandise Purchases

Transactions involving the buying of goods for resale by a retailer, wholesaler, distributor, or similar entity.

Merchandise Inventory

Goods that a company holds for the purpose of resale in the ordinary course of business, often considered as current assets on the balance sheet.

Q3: Department S had no work in process

Q3: The Pikes Peak Leather Company manufactures leather

Q12: Department B had 3,000 units in Work

Q14: The cost per equivalent units of direct

Q33: Selected accounts with a credit amount omitted

Q71: Issues such as population growth and climate

Q106: Multiple production department factory overhead rates are

Q114: Conversion costs are<br>A) direct materials and direct

Q120: The first step in determining the cost

Q170: Bobby Company has fixed costs of $160,000.