Tulip Company produces two products, T and U. The indirect labor costs include the following two items:

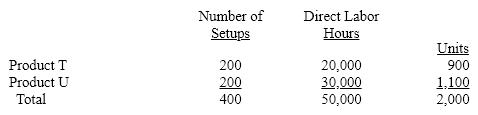

The following activity-base usage and unit production information is available for the two products:

(a) Determine the single plantwide factory overhead rate, using direct labor hours as the activity base.

(b) Determine the factory overhead cost per unit for Products T and U, using the single plantwide factory overhead rate.

(c) Determine the activity rate for plant supervision and setup labor, assuming that the activity base for supervision is direct labor hours and the activity base for setup labor is number of setups.

(d) Determine the factory overhead cost per unit for Products T and U, using activity-based costing.

(e) Why is the factory overhead cost per unit different for the two products under the two methods?

Definitions:

Technological Progress

Advances in technology that improve production efficiency, product quality, and innovation across sectors.

Roosevelt Administration

Refers to the period of Franklin D. Roosevelt's presidency in the United States from 1933 to 1945, marked by New Deal policies aimed at economic recovery from the Great Depression.

Federal Reserve

The leading bank system in the US tasked with managing and regulating America's financial and currency systems.

Deficit Spending

The practice of a government spending more money than it receives in revenue over a specific period, often leading to borrowing.

Q13: The flexible budget is, in effect, a

Q33: The Dawson Company manufactures small lamps and

Q47: In a process costing system, the cost

Q72: A manufacturing company applies factory overhead based

Q84: Process cost systems use job order cost

Q86: ABC is used to allocate selling and

Q88: In the absorption costing income statement, deduction

Q137: The first budget to be prepared is

Q151: In preparing flexible budgets, the first step

Q171: Job order cost accounting systems may be