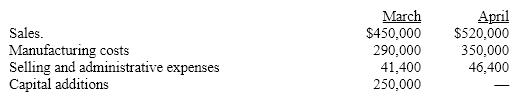

The treasurer of Calico Dreams Company has accumulated the following budget information for the first two months of the coming fiscal year:

The company expects to sell about 35% of its merchandise for cash. Of sales on account, 80% are collected in full in the month of the sale, and the remainder in the month following the sale. One-fourth of the manufacturing costs are paid in the month in which they are incurred, and the other three-fourths in the following month. Depreciation, insurance, and property taxes represent $6,400 of the monthly selling and administrative expenses. Insurance is paid in February, and property taxes are paid yearly in September. A $40,000 installment on income taxes is to be paid in April. Of the remainder of the selling and administrative expenses, one-half are to be paid in the month in which they are incurred and the balance in the following month. Capital additions of $250,000 are paid in March.

Current assets as of March 1 are composed of cash of $45,000 and accounts receivable of $51,000. Current liabilities as of March 1 are accounts payable of $121,500 ($102,000 for materials purchases and $19,500 for operating expenses). Management desires to maintain a minimum cash balance of $25,000.

Prepare a monthly cash budget for March and April.

Definitions:

Feasibility Determination

The process of assessing the practicality and viability of a proposed project or system.

Initial Experimentation

The preliminary phase of trying or testing new ideas, processes, or products to assess their feasibility or effectiveness.

Idea Creation

is the process of generating new, innovative concepts or solutions within a business or creative context.

Environmental Hazards

Potential sources of danger to the environment and human health, including pollutants, chemicals, and natural events that pose risks.

Q17: What were the political, social, economic, and/or

Q23: A negative fixed overhead volume variance can

Q45: Which of the following is true of

Q57: The amount of detail presented in a

Q75: Why is the sales budget usually prepared

Q106: The costs of services charged to a

Q117: S&P Enterprises sold 10,000 units of inventory

Q131: Big Wheel, Inc. collects 25% of its

Q139: Ruby Company produces a chair that requires

Q151: In preparing flexible budgets, the first step