*Actual hours are equal to standard hours for units produced.

*Actual hours are equal to standard hours for units produced.

The total factory overhead cost variance is:

Definitions:

Average Tax Rate

The percentage of total income that is paid as tax, calculated by dividing the total tax amount by the total income.

Marginal Tax Rate

The rate at which the next dollar of taxable income is taxed; refers to the percentage of tax applied to the last dollar earned.

Tax Base

The total amount of assets or income that can be taxed by a government, providing a source of revenue.

Q6: What were the political, social, economic, and/or

Q28: The budget that summarizes future plans for

Q30: In most businesses, cost standards are established

Q37: The responsibility for coordinating the preparation of

Q45: Which of the following is true of

Q45: The controllable variance measures<br>A) operating results at

Q63: Materials used by Best Bread Company in

Q64: The standard factory overhead rate is $10

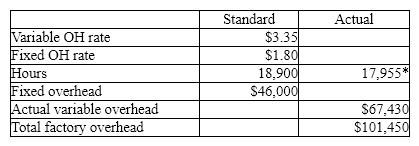

Q91: The following data is given for the

Q172: Describe at least five benefits of budgeting.