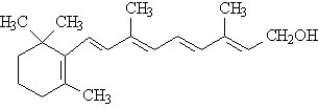

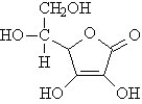

The vitamins A (retinol) and C (ascorbic acid) are shown below. All atoms other than C and H are explicitly shown.

A C

A C

Complete the following questions be entered in the appropriate letter (A or C) in the blank provided.

-The beaker below contains oil (a compound of mostly carbon and hydrogen) in the upper layer and water in the lower layer. Oil floats on top of the water because it is less dense.  The vitamin that would be the most soluble in the upper layer is ______.

The vitamin that would be the most soluble in the upper layer is ______.

Definitions:

Tax Year

The 12-month period for which tax is calculated, often either the calendar year or a fiscal year established by a business.

Eligible Educational Institution

An accredited post-secondary institution that qualifies for federal student aid programs, where expenses might be eligible for tax deductions or credits.

Loan Interest Deductibility

The ability to subtract the cost of interest on certain loans from your gross income for tax purposes, potentially lowering your taxable income.

Taxable Income

The portion of an individual's or entity's income used to determine how much tax is owed to the government, after all deductions and exemptions.

Q11: Which of the alcohols shown below will

Q21: Which of the following increases as temperature

Q26: Consider the formula given below. C<sub>4</sub>H<sub>8</sub> This

Q33: What is the meaning of the subscripts

Q40: The following would be classified as a

Q49: A mole of an element contains the

Q50: The half-life of a sample depends on

Q54: An appropriate unit to measure the length

Q62: Open marriage embodies concepts such as ownership

Q71: The osmotic pressure of a 0.10 M