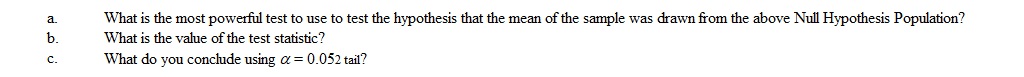

Assume that µ = 500 and s = 100. Your study shows a sample of size 22 with a mean of 530 and standard deviation of 113.

Definitions:

Joint Return

A tax return filed jointly by a married couple, combining their incomes, exemptions, and deductions.

Earned Income

Income derived from active employment and work, such as wages, salaries, tips, and professional fees.

Additional Standard Deduction

An extra deduction amount added to the standard deduction, available to certain taxpayers, such as the elderly or blind.

Single Taxpayer

A filing status for unmarried individuals that pay taxes separately from anyone else, often with different tax rates and standard deductions than those married or filing jointly.

Q45: In cases where N > 1, the

Q53: If results are statistically significant, the independent

Q86: F obt = MS<sub>within</sub> / MS<sub>between</sub>

Q89: Define P <sub>real</sub> and P <sub>null</sub>.

Q90: The sign test is used with the

Q93: Power is the probability of making a

Q99: As the degrees of freedom increase, the

Q134: Assuming that the population mean is 47.2

Q167: The value used in the Scheffé test

Q194: If F obt is significant, it is