In its 2009 annual report to shareholders, Ank-Morpork Times Inc. included the following disclosure:

REVENUE RECOGNITION

Advertising revenue is recognized when advertisements are published, broadcast or when placed on the Company's Web sites, net of provisions for estimated rebates, credit and rate adjustments and discounts.

Circulation revenue includes single copy and home-delivery subscription revenue. Single copy revenue is recognized based on date of publication, net of provisions for related returns. Proceeds from home-delivery subscriptions and related costs, principally agency commissions, are deferred at the time of sale and are recognized in earnings on a pro rata basis over the terms of the subscriptions.

Other revenue is recognized when the related service or product has been delivered.

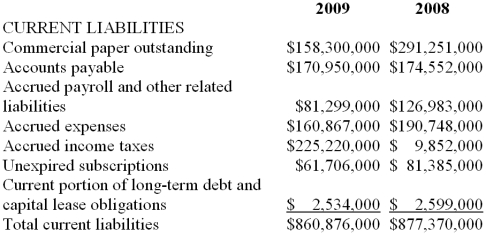

Also, the following information on its current liabilities was included in its comparative balance sheets:

Required:

Assuming that Ank-Morpork Times Inc. collected $440,000,000 in cash for home delivery subscriptions during fiscal year 2009, what amount of revenue did it recognize during 2009 from this source? Show the relevant T-account information to support your answer.

Definitions:

Accounting Records

Documentation and books involved in preparing financial statements, including ledgers, journals, and other evidence of transactions.

Allowance For Doubtful Accounts

A contra asset account on a company's balance sheet that represents the estimated portion of accounts receivable that may not be collectible.

Accounts Receivable

Funds that clients or customers owe to a company for products or services already provided but have yet to be paid for.

Partnership Agreement

A legal document that specifies the rights, responsibilities, and distribution of profits and losses among partners in a business partnership.

Q18: On March 1, 2009, Doll Co. issued

Q28: Required: Determine the amount, if any, of

Q53: Cornhusker Can Co. uses the conventional

Q54: Bonds usually sell at their:<br>A)Maturity value.<br>B)Face value.<br>C)Present

Q56: Required:<br>Assume Arctic Cat did not purchase any

Q61: The valuation allowance account that is used

Q70: What would the lessee record as annual

Q83: Which of the following usually results in

Q103: Cracker Corporation began a special promotion

Q113: Ordinarily, the proceeds from the sale of