In its 2009 annual report to shareholders, Ank-Morpork Times Inc. included the following disclosure:

REVENUE RECOGNITION

Advertising revenue is recognized when advertisements are published, broadcast or when placed on the Company's Web sites, net of provisions for estimated rebates, credit and rate adjustments and discounts.

Circulation revenue includes single copy and home-delivery subscription revenue. Single copy revenue is recognized based on date of publication, net of provisions for related returns. Proceeds from home-delivery subscriptions and related costs, principally agency commissions, are deferred at the time of sale and are recognized in earnings on a pro rata basis over the terms of the subscriptions.

Other revenue is recognized when the related service or product has been delivered.

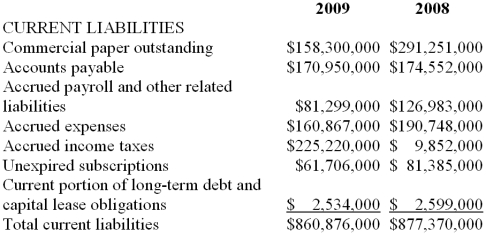

Also, the following information on its current liabilities was included in its comparative balance sheets:

Required:

Assuming that Ank-Morpork Times Inc. collected $440,000,000 in cash for home delivery subscriptions during fiscal year 2009, what amount of revenue did it recognize during 2009 from this source? Show the relevant T-account information to support your answer.

Definitions:

Pure Competition

A market structure characterized by a large number of small firms, a homogeneous product, and free entry and exit from the market.

Pure Monopoly

A market structure characterized by a single seller controlling the entire market supply of a unique product, with no close substitutes.

Economic Profits

Profits exceeding the opportunity costs of all resources used by the firm, indicating an above-normal return.

Monopoly Rights

The exclusive power granted to a company or individual to produce, sell, or conduct business in a specific market without competition.

Q4: Holding gains and losses on trading securities

Q18: The replacement of a major component increased

Q19: Once selected for existing assets, a company

Q25: Statutory depletion is the maximum amount of

Q41: Kellogg Company and its subsidiaries are engaged

Q58: Which of the following does not pertain

Q97: Captain Cook Cereal includes one coupon in

Q105: A company should accrue a loss contingency

Q124: On July 1, 2009, Clearwater Inc.

Q140: When a company issues bonds between interest