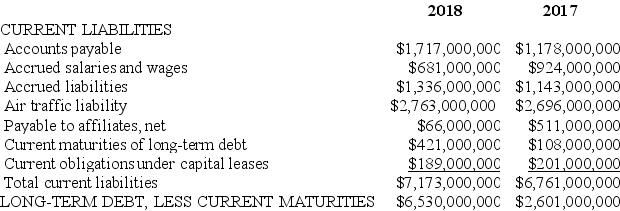

In its 2018 annual report to shareholders, Border Airlines Inc. presented the following balance sheet information about its liabilities:  In addition, Border presented the following among its note disclosures:

In addition, Border presented the following among its note disclosures:

Maturities of long-term debt (including sinking fund requirements) for the next five years are: 2019 - $421 million; 2020 - $212 million; 2021 - $273 million; 2022 - $1.0 billion; 2023 - $777 million.

Required:

Consider the appropriate classification of these long-term debt obligations. Assuming no more long-term debt will be issued, what are the implications of the information above for Border's liquidity and solvency risk in 2018 and the following years?

Definitions:

ITQs

Individual Transferable Quotas; regulatory tools used in fisheries management to control the total amount of fish that can be caught by allocating specific allowances to fishermen or companies.

Sockeye Salmon

A species of salmon found in the Pacific Ocean, known for its red flesh and high commercial value.

Market Price

The present cost at which a service or asset is available for purchase or sale on the market.

Environmental Quality

The condition or state of the environment based on various factors such as air and water purity, and the presence of pollutants or contaminants.

Q16: ABC Books is the lessor in a

Q54: Ivan Oder Co. recorded a right-of-use asset

Q61: As part of the multi-step approach to

Q73: Which of the following investment securities held

Q99: Briefly differentiate between activity-based and time-based allocation

Q143: If an investment is accounted for under

Q167: Depreciation<br>A)Allocation of cost for plant and equipment.<br>B)Is

Q209: An impairment loss has the effect of:<br>A)

Q229: Tru Fashions has bonds outstanding during a

Q245: Debenture bonds<br>A)May become stock.<br>B)Measures default risk.<br>C)Name of