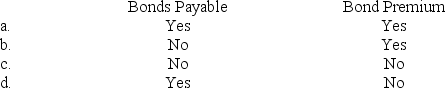

When outstanding bonds are converted into common stock, under either the book value method or the market value method, the same amount would be debited to:

Definitions:

Market Value

The existing market rate at which you can purchase or sell an asset or service.

Book Value

The value of an asset as shown on a company's balance sheet, calculated as the cost of the asset minus any depreciation and amortization.

Capital Balance

The amount of funds contributed by owners or shareholders to a business, plus retained earnings and reduced by any withdrawals or distributions.

Asset Revaluation

The process of adjusting the book value of an asset to reflect its current market value.

Q18: M Corp. has an employee benefit plan

Q96: Discuss the financial statement disclosure requirements for

Q104: Balance times effective rate<br>A)No specific assets pledged<br>B)Legal,

Q118: What was General's coupon liability as

Q165: Valuation allowance<br>A)No tax consequences.<br>B)Produces future taxable amounts

Q193: In an eight-year finance lease, the portion

Q194: On January 1, 2017, Slug Corporation issued

Q202: What is meant by the "market rate"

Q205: On August 1, 2019, United Corporation issued

Q245: Debenture bonds<br>A)May become stock.<br>B)Measures default risk.<br>C)Name of