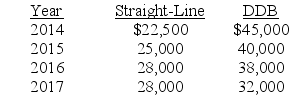

Weaver Textiles Inc. has used the straight-line method to depreciate its equipment since it started business in 2014. At the beginning of 2018, the company decided to change to the double-declining-balance (DDB) method. Depreciation as reported and as it would have been reported if the company had always used DDB is listed below:  Required:

Required:

What journal entry, if any, should Weaver make to record the effect of the accounting change (ignore income taxes)? Explain.

Definitions:

Flexible Budget

A customizable budget that adjusts based on operational volume or activity fluctuations.

Activity Level

A factor that measures the amount of production or work accomplished, often used in cost accounting to determine costs based on different levels of operation.

Activity Variance

A metric used in cost accounting to measure the difference between planned activity and actual activity, often analyzed to improve budgeting and control processes.

Direct Labor

The labor costs that can be directly traced to the production of specific goods or services.

Q18: M Corp. has an employee benefit plan

Q69: Jeremiah Corporation purchased debt securities during 2018

Q70: Investments in securities to be held for

Q79: Many corporations own more than 50% of

Q91: For companies using LIFO, inventory is valued

Q109: ATC's gross profit ratio (rounded) in 2018

Q122: In applying the lower of cost

Q141: If Dinsburry Company concluded that an investment

Q146: Braxwell Corporation acquired the following assets associated

Q150: During periods when costs are rising and