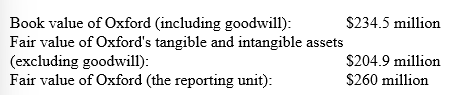

In 2017, Dooling Corporation acquired Oxford Inc. for $250 million, of which $50 million was attributed to goodwill. At the end of 2018, Dooling's accountants derive the following information for a required goodwill impairment test:

-Assume the same facts as above, except that the fair value of Oxford (the reporting unit) is $225 million.

Required: Determine the amount, if any, of the goodwill impairment loss that Dooling must recognize on these assets.

Definitions:

Accounts Payable

Liabilities to creditors that must be paid within a short period, usually less than a year.

Operating Activities

Activities that constitute the primary or main activities of an organization, including production, sales, and delivery of services.

Cash Dividend

A cash distribution given to shareholders from the company's earnings.

Balance Sheet

A financial statement that summarizes a company's assets, liabilities, and stockholders' equity at a specific point in time.

Q2: California Inc., through no fault of its

Q12: Company A is identical to Company B

Q17: In 2018, Cap City Inc. introduced a

Q51: Modern Day Appliances, Inc. is a wholesaler

Q63: Watson Company purchased assets of Holmes

Q80: Required: Compute the January 31 ending inventory

Q92: Estimated ending inventory at retail is:<br>A) $65,000.<br>B)

Q136: If the fair value of a trading

Q137: Rockport Refinery acquired all the outstanding

Q157: Dyckman Dealers has an investment in Thomas