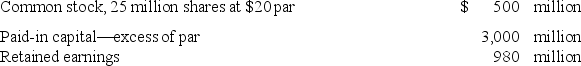

The 12/31/2018 balance sheet of Despot Inc. included the following:  In January 2018, Despot recorded a transaction with this journal entry:

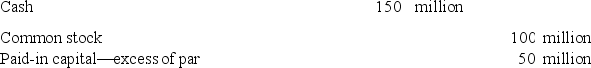

In January 2018, Despot recorded a transaction with this journal entry:

- Despot declared a property dividend to give marketable equity securities to its common stockholders. The securities had cost Despot $7 million and currently have a fair value of $16 million. Which of the following would be included in recording the property dividend declaration?

Definitions:

Variable Expenses

Costs that change in proportion to the level of activity or production volume.

Break-Even Sales

The amount of revenue needed to cover all fixed and variable costs, resulting in a net income of zero.

Retail Division

A segment of a company that directly sells products to consumers, typically involving activities and costs related to retail operations.

Segmented Income Statement

An income statement that breaks down revenues, cost of sales, and expenses by segments such as product lines, departments, or geographic regions.

Q3: In a defined benefit pension plan, the

Q10: The owners of a corporation are its

Q60: In 2018, due to a change in

Q68: Service cost<br>A)Risk borne by employee.<br>B)Return on plan

Q90: Loss-other comprehensive income<br>A)Created only by the passage

Q129: A company overstated its liability for warranties

Q135: Vested benefit obligation<br>A)Future compensation levels estimated.<br>B)Not contingent

Q153: The valuation allowance account that is used

Q159: In 2018, Poe's Products completed the treasury

Q170: A company's total obligation for postretirement benefits