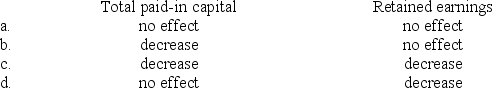

Dempsey Company retires shares that it buys back. In its first share repurchase transaction, Dempsey purchased stock for more than the price at which the stock was originally issued. What is the effect of the purchase of the stock on each of the following?

Definitions:

Tax Liability

The amount of total tax debt owed by an individual or entity to the taxing authority, such as the IRS, after all deductions, credits, and exemptions.

Taxable Qualified Dividend

Dividends that meet certain criteria set by the IRS to be taxed at the lower long-term capital gains tax rates.

Cash Receipts And Disbursements Method

An accounting method where income and expenses are recorded when they are actually received or paid.

Tax Returns

Tax Returns are official documents that taxpayers must file with the government, reporting their income, expenses, and other tax-related information.

Q3: In a defined benefit pension plan, the

Q72: Why are preferred dividends deducted from net

Q96: Which of the following changes would not

Q101: Washburn Co. spent $10 million to purchase

Q116: In 2018, internal auditors discovered that Fay,

Q124: Rice Inc. had 420 million shares of

Q132: What is the "if converted method"?

Q155: Reliable Corp. had a pretax accounting income

Q224: A net gain or net loss affects

Q231: The estimated medical costs are expected to