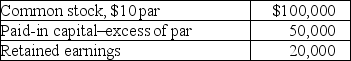

Fowler Co.'s balance sheet showed the following at December 31, 2018:  A cash dividend is declared on December 31, 2018, and is payable on January 20, 2019, to shareholders of record on January 10, 2019.

A cash dividend is declared on December 31, 2018, and is payable on January 20, 2019, to shareholders of record on January 10, 2019.

Required:

(1.) Prepare all appropriate journal entries, assuming a cash dividend in the amount of $1.00 per share.

(2.) Prepare all appropriate journal entries, assuming a cash dividend in the amount of $5.00 per share.

Definitions:

Distribution to Partners

Refers to the distribution of profits, income, or assets from a partnership to its partners, typically in proportion to their ownership interests.

Managing Partner

A member of a partnership who has the authority and responsibility for managing the everyday operations of the business.

Partnership Assets

Assets or property owned jointly by partners in a business partnership, used for the business’s operations.

Fiduciary Duty

An obligation to act in the best interest of another party. For instance, a fiduciary duty exists between a trustee and the beneficiaries of the trust.

Q27: <br>What is Falwell's basic earnings per share

Q31: On October 15, 2018, a 5% stock

Q57: Pension data for Goldman Company included

Q58: On December 31, 2017, Rebel Corporation's

Q104: Gear Corporation had the following common

Q115: The following is an incomplete pension spreadsheet

Q122: DeAngelo Yards, Inc., calculated pension expense for

Q140: A gain from changing an estimate regarding

Q153: The following information comes from the 2018

Q190: Lance Chips granted restricted stock units (RSUs)